ev charger tax credit federal

As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations. State andor local incentives may also apply.

Atom Power Launches Puprl Ev Charging Solution Charging Directly From Circuit Breaker Green Car Congress

Did you install charging in 2017 or 2018.

. Congress recently passed a retroactive now includes 2018 2019 2020 and through 2021 federal tax credit for those who purchased EV charging infrastructure. Nonprofits private sector individuals. The federal government offers tax incentives for businesses to install Level two and three EV chargers.

We think ChargePoint Home Flex is a great choice because it charges up to 9X faster than a wall. Federal EV Charger Incentives. Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station.

Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to 1000 for residential installations and up to 30000 for commercial installations. Consumers who purchased qualified residential charging equipment prior to December 31 2021 may receive a tax credit of up to 1000. For commercial property assets qualifying for depreciation the credit is equal to 30 of the combined purchase and installation costs for each location limited to a credit of 30000.

It covers 30 of the costs with a max of 1000 credit for residents and 30000 tax credit for commercial installs. The main thing that should prevent EV sales from crashing until the end of the year is. It covers 30 of the costs with a maximum 1000 credit for residents and 30000 federal tax credit for commercial installs.

Unlike some other tax credits this program covers both EV charger hardware AND installation costs. You could have received a federal EV charger tax credit of up to 30 of your commercial electric vehicle supply equipment infrastructure and installation cost or up to 30000. The federal EV tax credit may go up to 12500 EV tax credit for new electric vehicles.

Use this form to figure your credit for alternative fuel vehicle refueling property you placed in service during your tax year. Although this tax credit expired at the end of 2021 pending legislation has proposed extending it Eligible EV activities. The federal 2020 30C tax credit is the largest incentive available to businesses for installing EV charging stations.

The Build Back Better Act which would have increased the maximum electric vehicle tax credit to 12500 was defeated in Congress. The federal government offers a tax credit for EV charger hardware and EV charger installation costs. For residential installations the IRS caps the tax credit at 1000.

30 tax credit up to 1000 for residential and 30000 for commercial. Any credit not attributable to depreciable property is treated as a. Under the Biden administration there are high hopes that these EV charging tax credits will continue and even expand.

How to Claim Your Federal Tax Credit for Home Charging Buy a home EV charger. The incentive can be a large percentage of the charger and installation costs. For non-commercial property the same 30 applies but the credit cap is 1000 and limited to property placed in service at the taxpayers primary home.

The federal tax credit covers 30 of an EV charging station necessary equipment and installation costs. That could mean up to 30 savings and if your business spends 50000 on EV charger installation you could get up to 15000 back in federal funds. Request a quote from our network of trusted installers or find an electrician on your own.

Those who bought before were able to get a Federal tax credit of 4000 in addition to credits ranging from 1000 to 4000. You use form 8911 to apply for the Federal EV charging tax credit. After that it largely depended on the fuel efficiency rating of the vehicle.

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. This incentive covers 30 of the cost with a maximum credit of up to 1000. Customers who purchase and install EV chargers can receive up to 6000 per Level 2 Charger and up to 70000 per DC Fast Charger.

This federal EV infrastructure tax credit will offset up to 30 of the total costs of purchase and installation of EV equipment up to a maximum of 30000 for commercial property and 1000 for a primary residence. Entities in Disadvantaged Communities DAC are eligible to receive an additional 500 per Level 2 Charger and up to 10000 per DC Fast Charger. Previously this federal tax credit expired on December 31 2017 but is now extended through December 31 2021.

If you purchased a fuel cell car after January 1 st 2017 youre no longer able to claim Federal tax credits on these cars. You may be eligible for a credit under section 30D g if you purchased a 2- or 3-wheeled vehicle that draws energy from a battery with at least 25 kilowatt hours and may be recharged from an external source. It applies to installs dating back to January 1 2017 and has been extended through December 31 2021.

421 rows Federal Tax Credit Up To 7500. Residential installations could have received a credit of up to 1000. The new credit applies to electric vehicles delivered after December 31 2022 meaning delivered in 2023.

However I cant find any evidence of this being valid past 123121. The credit amount will vary based on the capacity of the battery used to power the vehicle. FEDERAL TAX CREDIT FOR EVSE PURCHASE AND INSTALLATION EXTENDED.

The federal government offers a tax credit for EV charger hardware and EV charger installation costs. Just buy and install by December 31 2021 then claim the credit on your federal tax return. Federal tax credit gives individuals 30 back on a ChargePoint Home Flex EV charger and installation costs up to 1000.

And its retroactive so you can still apply for installs made as early as 2017. For every kilowatt-hour of capacity above 5 kilowatt-hours the credit goes up by 417 capping out at 7500. After the base 2500 the tax credit adds 417 for a 5-kilowatt-hour battery.

It covers 30 of the costs with a maximum 1000 credit for residents and 30000 federal tax credit for commercial installs. You can still apply for installs as early as 2017. If you go with an all-electric vehicle the odds are higher that youll.

Since installation costs are significant for EV chargers this rule allows you to get the most tax credit. However the credit is worth up to 7500 depending on the size of the battery. The credit attributable to depreciable property refueling property used for business or investment purposes is treated as a general business credit.

Current EV tax credits top out at 7500. The charging station must be purchased and installed. You must have purchased the vehicle in 2012 or 2013 and begun using it in the year in which you claim the credit.

The credit is 10 of the. Grab IRS form 8911 or use our handy guide to get your credit.

Feds Tally 5b For Ev Charging Stations Expected To Reach Private Firms Fierce Electronics

Guide To Home Ev Charging Incentives In The United States Evolve

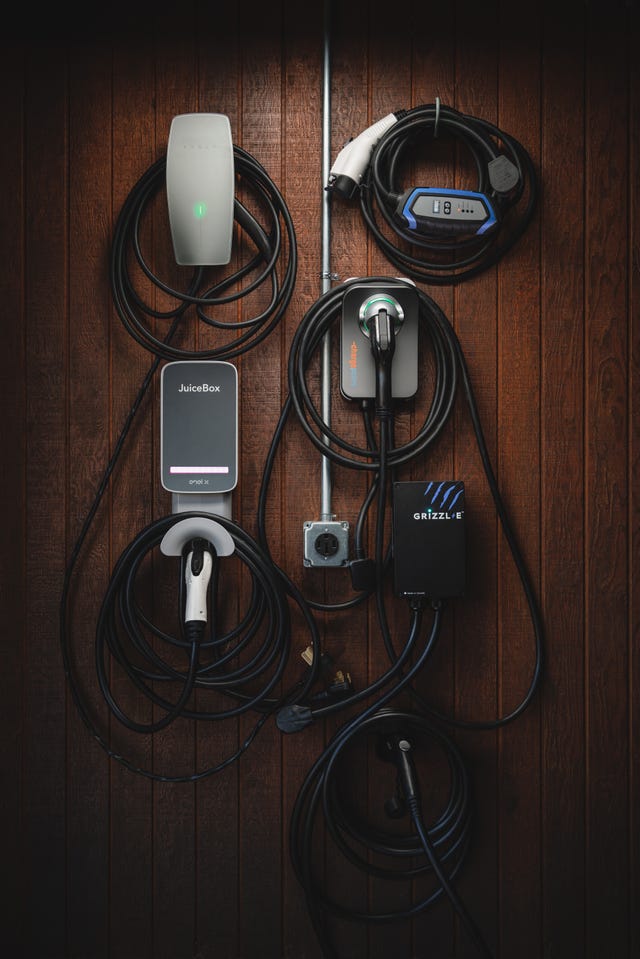

Best Ev Chargers For 2022 Tested Car And Driver

What Role Will Utilities Play In The Ev Charging Infrastructure Build Out Pwc

Ev Charging Stations Provide Key Business Benefits Powering Chicago

The Benefits Of Ev Charging Stations

Commercial Ev Charging Incentives In 2022 Revision Energy

Not Nearly Enough Money For Ev Charging In The Infrastructure Bill

Ev Charging Tacoma Public Utilities

Tax Credit For Electric Vehicle Chargers Enel X Way

Charging And Driving An Ev In The Rain Or Winter Snow Answering Common Questions Smart Electric Vehicle Ev Charging Stations

Residential Charging Station Tax Credit Evocharge

Ev Charging Speeds Charging Levels And Charging Stations What S The Difference Smart Electric Vehicle Ev Charging Stations

What Are The Ev Charger Levels

Ev Charging And The Infrastructure Bill Converting Federal Investments Into Local Impact