best buy 401k withdrawal

Just seeing if anyone has pulled from their 401K during the pandemic. People do this for many reasons including.

How To Take 401 K Hardship Withdrawals

Costs related to the purchase or repair of a home or eviction.

. If you call them and request either a loan or withdrawal they will go over a few questions and then process it either as direct deposit or a mail check. 401k Withdrawal To Buy A Home Deals 54 Off Www Alforja Cat 401 K Early Withdrawal Guide Forbes Advisor. But first a quick review of the rules.

Ad Build Your Future With a Firm that has 85 Years of Retirement Experience. Home 401k best buy withdrawal. And account-holders of any age may if their employer.

Did you just have to pay the taxes on it assume its 30. You can roll over the funds from your Best Buy 401 k into the new employers plan and effectively pay no penalty. You can start withdrawing funds from a 401 k or IRA without penalty after age 59 12 but you dont have to start taking required minimum distributions RMDs from tax-deferred retirement accounts until age 72 70 12 if you reached age 70 12 before Jan.

In most cases loans are an option only for active employees. A Book Guide For The Boss. If you took an early withdrawal of 10000 from your 401 k account the IRS could assess a 10 penalty on the withdrawal if its not covered by any of the exceptions outlined.

Best buy 401k withdrawal Monday July 11 2022 Edit. Youll still need to collect the tax forms every year to give you your tax preparer but you wont be putting any money into it. If so you may be able to borrow from your account invest the funds and create a.

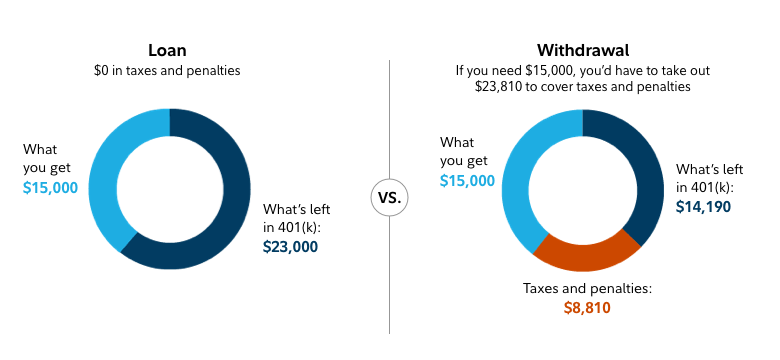

As of 2021 if you are under the age of 59½ a withdrawal from a 401 k is subject to a 10 early withdrawal penalty. Borrow Instead of Withdraw From Your 401 k Some plans let you take out a loan from your 401 k balance. Permanent or total disability.

A 401 k loan may be a better option than a traditional hardship withdrawal if its available. Take required minimum distributions to avoid penalties. The 401K Plans For Employers.

Under the SECURE Act employees can withdraw up to 5000 from a retirement plan to cover the birth or adoption of a child penalty-free. If your companys 401 k allows periodic withdrawals ask about transaction fees particularly if you plan to withdraw money frequently. Retirement plans 401k IRA roth.

I need emergency funds. Consider these retirement account withdrawal strategies. About one-third of all 401 k plans charge retired.

If you opt for a 401 k loan or withdrawal take steps to keep your retirement savings on track so you dont set yourself back. Enter username and password to access your secure Voya Financial account for retirement insurance and investments. Taking Normal 401k Distributions.

I Got My Own 401k Plan. Withdraw funds in years when you are in a low tax. Rachel Hartman April 7 2021.

Theyre taxed as ordinary income. Early 401 k Withdrawal Rules. You will also be required to pay regular income taxes on the withdrawn funds.

I know BBY setup some special provisions for financial hardship and such. Those who become permanently and totally disabled are. A Response to Aaron Browns July 21 2020 Bloomberg Opinion Article About 401k Plans.

Theyre also subject to an extra 10 penalty but there are some exemptions to this rule. A loan lets you borrow money from your retirement savings. Early withdrawals are those that are taken from a 401 k before you reach age 59 12.

You can take the money penalty-free if youre totally and permanently disabled if you lose your job. If youre at least 59½ youre permitted to withdraw funds from your 401 k without penalty whether youre suffering from hardship or not. My new FT has a guaranteed pension after 30 years and I could use the money I set aside in the 401K.

Walmart 401k Hardship Withdrawal With Merrill Lynch Irs Tax Rules Crd Distributions April 20 Youtube. Removing funds from your 401 k before you retire because of an immediate and heavy financial need is called a hardship withdrawal. There are no RMDs during the account owners.

A Roth IRA works differently. Unexpected medical expenses or treatments that are not covered by insurance. Birth or adoption of a child.

Usually when you get to your new employer they might have a 401 k option as well. Know Where You Stand and How to Move Toward Your Goals With Informed Confidence. This option is still available to employees.

The IRS dictates you can withdraw funds from your 401k account without penalty only after you reach age 59½ become. Thanks for any help. Ad If you have a 500000 portfolio download your free copy of this guide now.

When Is It Ok To Withdraw Money Early From Your 401k

Early 401k Withdrawal Explained Your Aaa Network

How Much To Save For Retirement Are You On Track Infographic Finance Infographic Budgeting Money Budgeting

401 K Withdrawals Everything You Need To Know Gobankingrates

401 K Hardship Withdrawal Seeking Alpha

Avoid Costly Tax Mistakes Ira 401 K Withdrawal Pe Ticker Tape

401k Withdrawal Myfico Forums 6349039

401 K Early Withdrawal Overview Penalties Fees

The Cares Act Makes It Easier To Withdraw From Your 401 K Money

Hardship 401 K Withdrawal Qualifications Taxes Ira Financial Group

401k Plan Loan And Withdrawal 401khelpcenter Com

A Rollover For Business Startups Robs Is A Way To Invest Funds From Your Retirement Account Like A 401k Or Business Loans Start Up Business Retirement Fund

How To Withdraw Early From A 401 K Nextadvisor With Time

How To Withdraw From 401k Or Ira For The Down Payment On A House

401 K Withdrawals What Know Before Making One Ally

Should I Close My 401k Withdraw Retirement Savings

Can First Time Home Buyers Use 401 K To Fund The Purchase Oberer Homes

Accessing 401 K Assets Early Know The Options And The Potential Hurdles Ascensus