foreign gift tax cpa

By Ken Kathcart CPA. You also need to file if you received more than 16388 from foreign corporations or partnerships.

Transactional Tax Issues For Foreign Investors In Us Real Estate

Person that you treat as a gift or bequest.

. The Tax Law Office of David W. The State Department is unable to provide a complete list and accounting of gifts presented to former President Donald Trump former Vice President Mike Pence and other officials during the final. For foreign partnerships or corporations the amount in 2022 is.

In the following situations you need to file a Form 3520 with the IRS. For gifts from nonresident aliens or individual estates this amount is 100000. At MEDOWS CPA our NYC Certified Public Accountants are well versed in issues pertaining to foreign taxes such as foreign gifts.

Fast And Free Advice. Certain distributions will be considered 100 taxable if the US. If you are a US.

For distributions from foreign entities the penalty is equal to the greater of 10000 or 35 of the gross value of the distributions from the foreign entity. If it is not reported the US. Estate tax that could be due on death.

Reporting is required if aggregate foreign gifts from a nonresident alien or individual estate and from foreign partnerships or corporations exceeds a certain amount during the given tax year. Form 3520 is an informational return and not a tax return because foreign gifts are not subject to income tax. Once the 100000 threshold has been surpassed the recipient must separately identify each giftinheritance that is more than 5000.

Due to currency restrictions your parents want to gift you the money abroad into your. Vetted Trusted by US Companies. If you received more than a certain threshold amount you must furnish certain.

Ad Get Quotes From Experienced Accountants Near You. Receive over 16388 from foreign corporations or partnerships. Gifts received by US persons from other US persons are simply subject to.

To make an appointment about your foreign gift tax liability call 541 362-9127. You and your parents spoke to a Tax Planning CPA who explained that it is better for the home to be under your name in case anything was to happen unexpectedly Estate Tax. First even though IRC section 6039F requires reporting gifts from a single foreign donor or from multiple related foreign donors that aggregate 10000 per year the IRS has administratively increased the reporting threshold to 100000 IRS Notice 97-34.

Former President Donald Trump walked away from the White House last year without providing the State Department with a legally required accounting of the gifts he received from foreign governments. Person receives a gift from foreign person and the value of gift exceeds either the individual foreign person or entity foreign person threshold the gift must be reported. Klasing is a boutique California tax firm comprised of award-winning nationally recognized Tax Attorneys and CPAs.

Gift tax would be due on gifts exceeding the 15000 exclusion amount. Here since you the preparer did not learn about the 200000 gifts until a subsequent year the penalty that each child is facing is 50000. Unfortunately the CPA neglected to discuss gift reporting FBAR and FATCA.

Foreign Trust and Foreign Gift. 5 This value is adjusted annually for inflation. This legislation governs the rules for gifts given to United States citizens by former US.

Person who received foreign gifts of money or other property you may have to report these gifts on the IRS Form 3520 Annual Return to Report Transactions with foreign Trust and Receipt of Certain Foreign gifts. Person is required to report the receipt of gifts from a nonresident or foreign estate only if the total amount of gifts from that nonresident or foreign estate is more than 100000 during the tax year. Tax Attorney for Domestic and International Tax Issues Serving All of California.

The penalty for failing to file Form 3520 is 5 of the value of the gift per month not to exceed 25 for each person who received a gift with a minimum fine of 10000. Regarding the latter as of 2019 you will need to file Form 3520 if youre a US. Real estate will result in a gift tax owed by the foreign person making the gift.

Person other than an organization described in section 501 c and exempt from tax under section 501 a who received large gifts or bequests from a foreign person you may need to complete Part IV of Form 3520 Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts and file the form by the 15th day of the fourth month. The IRS recently issued long-awaited guidance on the Heroes Earnings Assistance and Relief Tax Act of 2008 the HEART Act. Person may be subject to Form 3520 penalties which are usually 25 value of the gift.

Avoid a direct gift of US. The gift rate is 40 on the amount transferred. When IRS Form 3520 Is Due IRS Form 3520 should generally be filed by the 15th day of the fourth month following the end of the recipients tax year.

Citizen and you received 100000 or more from a nonresident alien individual or foreign estate that you treated as a gift or bequest. A direct gift of US. If you are a US.

Receive over 100000 of gift or bequest from foreign individuals or estate. Form 3520 and 3520-A. Exclusive Network of Top-Tier Freelance Accountants.

Milan Madhani CPA Vimal Madhani MST EA of Vimlan Tax Services LLC Monies received from foreign sources are always a point of curiosity when it comes to determining US tax consequences. The gift tax rates start at 18 and increase to a maximum rate of 40. The value of the gifts received from foreign corporations or foreign partnerships must exceed 16815 as of tax year 2021.

A foreign gift is any amount received from a person other than a US. 6039F for failure to report foreign gifts of persons not involving trusts. If you own a foreign trust and you are a US person you need to file Form 3520-A annually.

Gifts from Foreign Nationals Reporting Requirements. Foreign Gift Reporting. Citizens and long-term residents who expatriate on or after June 17 2008 and are classified as covered.

Receive distribution from a. To make the situation even worse foreign nationals are often under the mistaken belief that by adding the names of their children to the title of the property it will reduce the amount of US. Ad Empowering the Future of Finance Work.

CPA Ted Kleinman has over three decades of experience and knowledge in dealing with IRS tax regulations and he will ensure that your tax needs are addressed. For foreign gifts you may be subject to a penalty equal to 5 but not to exceed 25 of the amount of the foreign gift or bequest for each month for which failure to report continues. Beneficiary is not provided with adequate accounting details from the foreign trust.

The Irs Is Targeting High Net Worth Individuals With More Audits How To Be Prepared

Should You Renounce Your U S Citizenship For Tax Reasons

Nfts Draw Scrutiny From Irs Berdon Llp

Understanding Firpta Non Resident Property Tax David W Klasing

Us Citizenship Renunciation What You Need To Know Online Taxman

Greg A Still Cpa Mst Tax Director The Mfa Companies Linkedin

Educating Supporting Representing Income Tax Chartered Tax Consultant Applied Tax Module 3 Ken O Brien 25 Th 26 Th January Ppt Download

Receiving An Inheritance From Abroad Special Considerations For U S Taxpayers Round Table Wealth

International Tax Lawyers Sherayzen Law Office Tax Lawyer Attorney

Accounting 4570 5570 N Chapter 16 International Taxation Issues Ppt Download

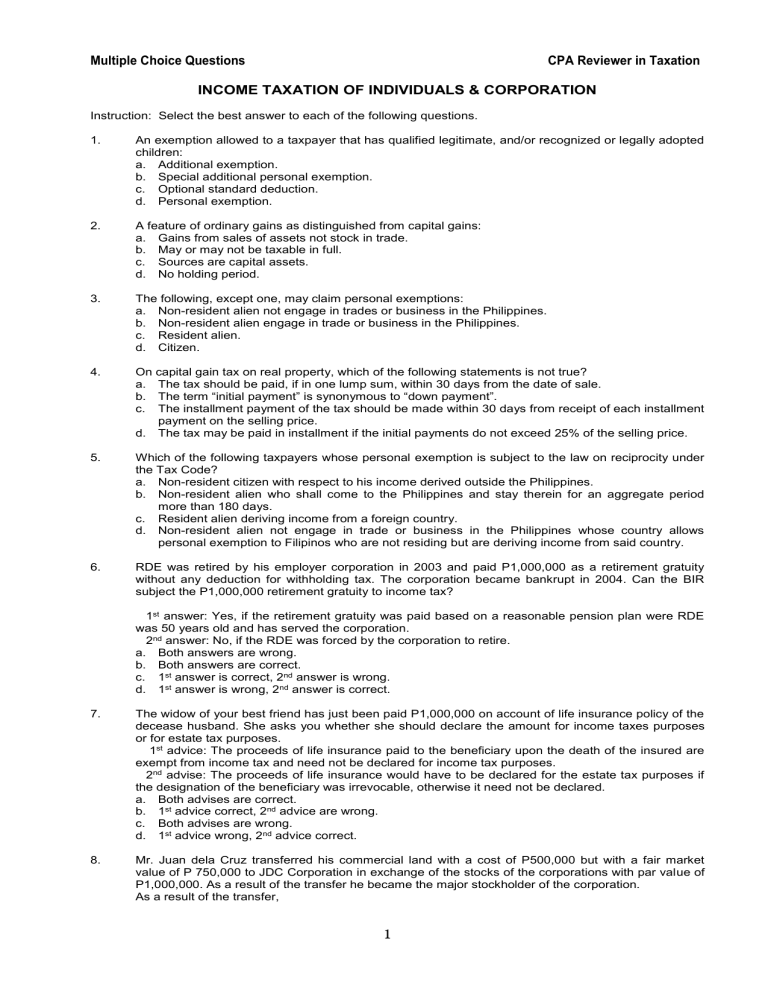

The Cpa Licensure Examination Syllabus Taxation

![]()

How To Bring Money From India To The Us

Green Card Holders Expat Tax Professionals

International Tax Accounting Baldwin Accounting Cpa Orlando Florida

How Does The Irs Find My Foreign Offshore Account Investments Income Fbar Fatca 8938 5471 Youtube

Can Us Expats Receive Irs Tax Refunds Bright Tax

A Cpa Reveals The 10 Biggest Tax Mistakes People Make Filing Taxes Income Tax Return Tax Time